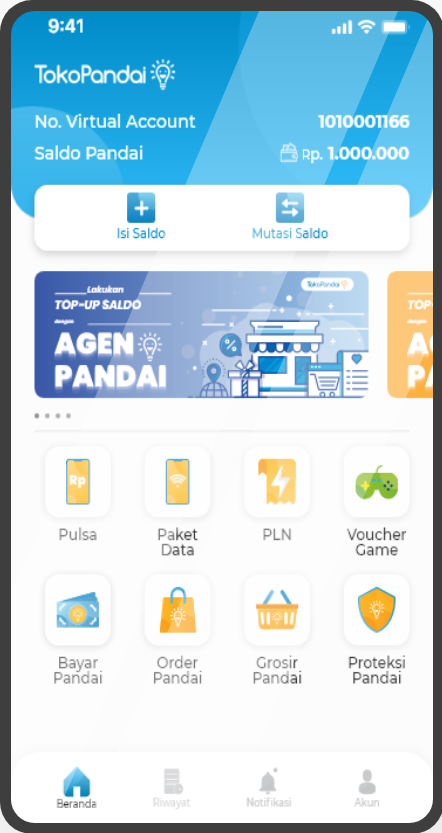

FEATURES

of Tokopandai

OUR MISSION

To create a strategy alliances with reputable principles and distributors aiming to enhance the capability and competitiveness of small to medium retail stores throughout the nation, by seamlessy connecting them to their key stakeholders via the construction of TOKOPANDAI DIGITAL PLATFORM

BENEFIT

for Prinsipal & Distributors

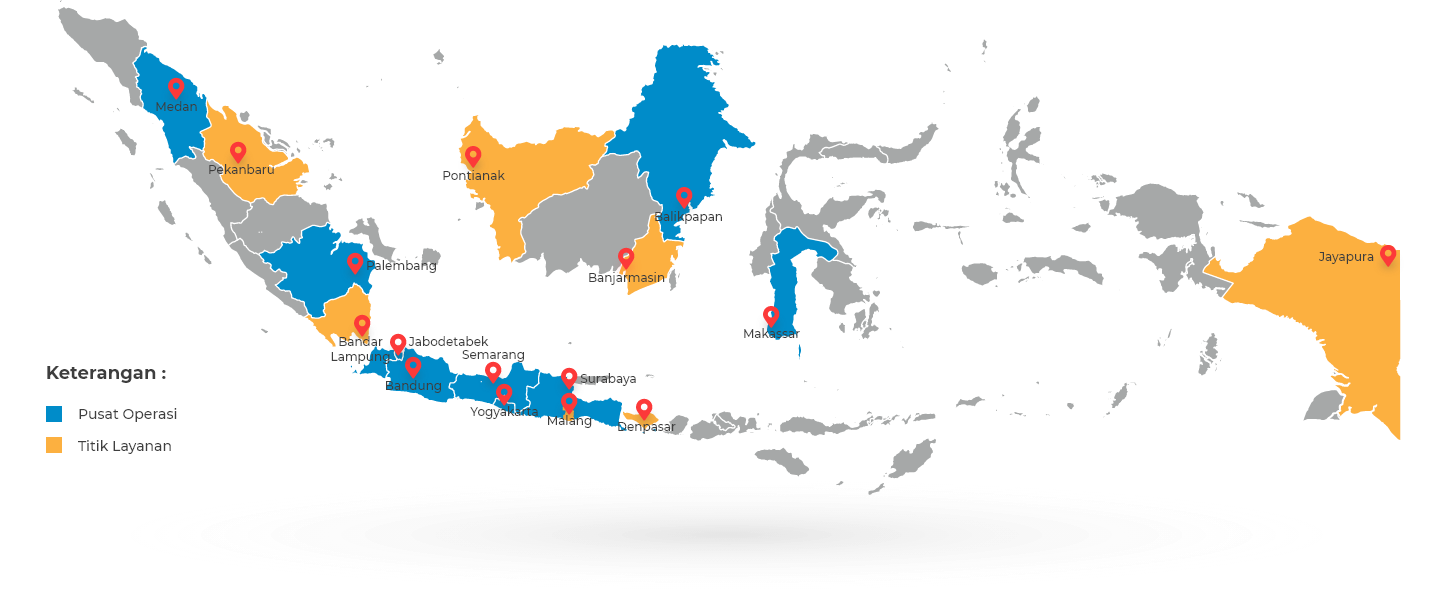

OPERATION READINESS

Toko Pandai

Operation Centers

- Medan

- Palembang

- Jakarta

- Semarang

- Yogyakarta

- Surabaya

- Tangerang

- Bandung

- Balikpapan

- Makassar

Points of Services

- Pekanbaru

- Bandar Lampung

- Malang

- Denpasar

- Pontianak

- Banjarmasin

- Jayapura

A BRIEF HISTORY

of Tokopandai

WHY US

Let’s join the platform to boost your Growth,

Security & Productivity PLUS to help THE LITTLE GUY againts THE BIG GUY

Security & Productivity PLUS to help THE LITTLE GUY againts THE BIG GUY